May 06, 2022

Prepare Your Portfolio for Midterm Elections

Midterm elections are just a few months away. This can mean only one thing … a flurry of political ads interrupting your favorite television shows.

All jokes aside, you can also expect to see plenty of platforms built around the President’s handling of the pandemic, the response to Russia’s invasion of Ukraine and our current economic landscape. With inflation at a 40-year high and the expectation that the Federal Reserve will aggressively raise their key short term lending rate by the end of the year, voters will likely be tuned into how each party plans to handle the precarious position of our economy.

No one has a crystal ball to see how the election will turn out. But I have learned one thing throughout the years: the financial media will be quick to pick apart both party’s suggested policies and their potential impact to different areas of the stock market. You’ll hear statistics over the next few months conjecturing that a change in congressional control will create investment opportunities. Many of those articles will go on to suggest that you should reposition your portfolio to take advantage of the changing agenda in Washington. However, one of my favorite sayings is that there’s nothing new in investing, just investment history we don’t yet know. Before you make any changes to your portfolio, consider what we can learn from history.

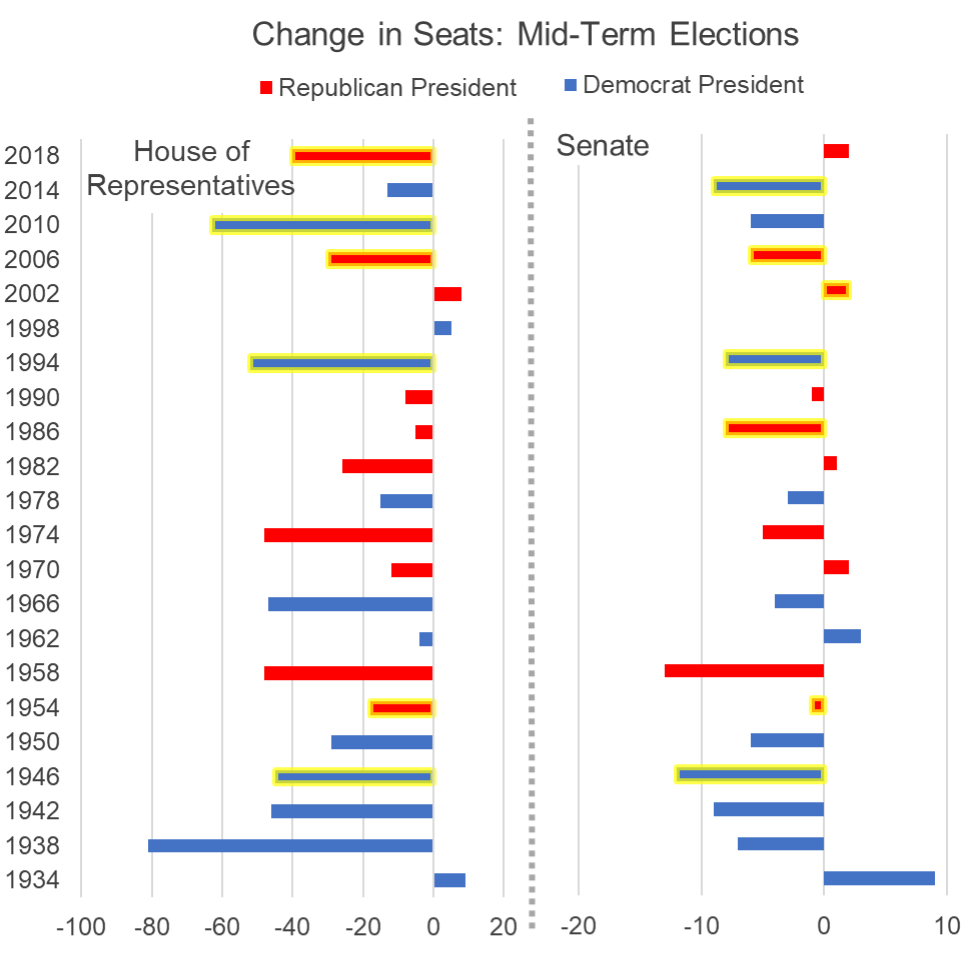

Graph 1: Change in number of seats controlled by the president’s party in both the House of Representatives and the Senate during the midterm elections since 1934. Election changes highlighted in yellow indicate a change in control of the respective part of Congress. Source: The American Presidency Project.

Graph 1 shows the change in the number of seats for the president’s party in midterm elections since 1934. Recent history has favored the challenging party, with the president’s party losing an average of 27 seats in the House during 19 of the last 22 midterm elections and losing an average of three Senate seats in 15 of those elections. Note that not every loss of seats meant a loss of control as many of those years saw the presidential party maintain majority in Congress. However, over the last roughly 90 years, the challenging party has retaken some ground in the midterm elections.

So, what does this mean for your portfolio? I’ll offer three points to consider.

First, even if control of Congress changes, remember that this is expected. Many theories exist as to why this happens, including a higher motivation of supporters of the challenging party, lower turn out in the midterms and dipping approval rating of the president. The key takeaway is that history teaches us to expect a loss of seats for the president’s party. Stock prices quickly respond to information and the expected impact to the future profits of companies, so we can reasonably assume this expectation is baked into current stock prices. We can still see the prices of stocks move the day after an election as we move from “what was expected to happen” to “what actually happened”. The bottom line: we shouldn’t expect huge swings if Democrats lose seats in Congress.

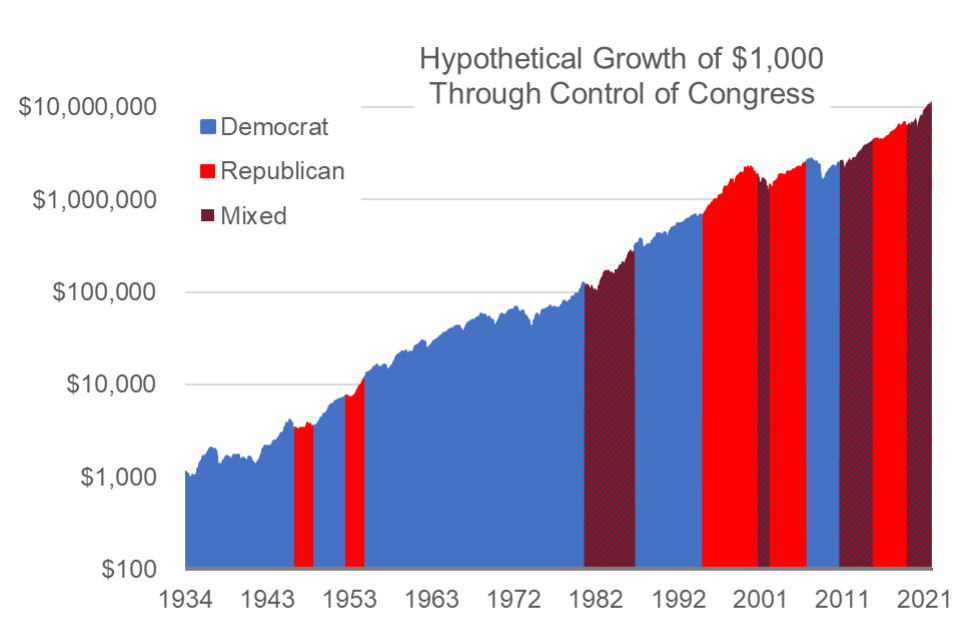

Graph 2: Hypothetical growth of $1,000 invested in the U.S. Total Stock Market beginning January 1934 and ending December 2021. Periods when the Democratic party controlled Congress are shaded blue, periods when the Republican party controlled Congress are shaded red and times when the House and Senate were controlled by different parties are indicated by the red/blue combo. Source: Ken French Data Library, house.gov and senate.gov. U.S. Market is a value weighted return of all CRSP firms incorporated in the U.S. and listed on the NYSE, AMEX, or NASDAQ. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio nor do indices represent results of actual trading. Information from sources deemed reliable, but its accuracy cannot be guaranteed. Performance is historical and does not guarantee future results. Total return includes reinvestment of dividends and capital gains.

The second key point to remember is that there has been no reliable pattern between a change in the control of Congress or president and the future returns in the market. Graph 2 shows us that a hypothetical $1,000 invested in U.S. stocks at the beginning of 1934 would have grown to over $11 million dollars by the end of 2021. On average, we’ve seen positive returns for U.S. stocks during years when Republicans controlled Congress, positive returns during years when Democrats controlled Congress and positive returns when Congress was split. Elections where we’ve seen a change in power in either part of Congress have been followed by a positive year in the stock market each time it happened. That’s not to say the opposite can’t happen – it just hasn’t happened over the last 90 years. Although I certainly see headwinds to the growth of U.S. stocks over the next few years (like high valuations, rising cost of debt and tighter budgets for consumers), the impact of a change in control of Congress isn’t high on that list.

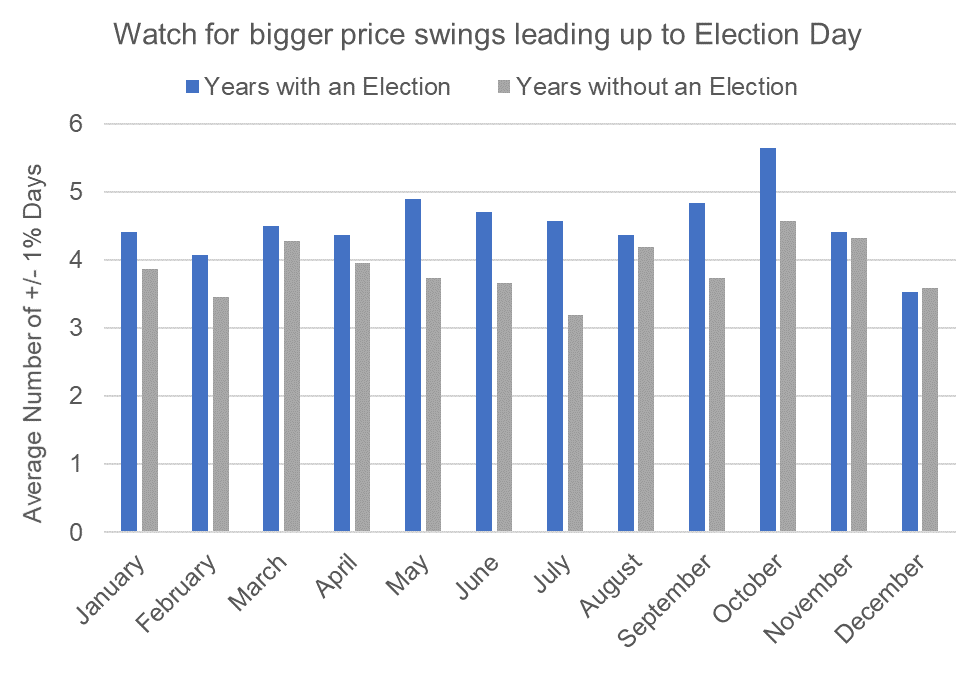

Graph 3: The average number of trading days in which U.S. stocks moved by more than 1%, split between election years and non-election years. Election years include years with either a midterm or presidential election. Source: Ken French Data Library. U.S. Market is a value weighted return of all CRSP firms incorporated in the U.S. and listed on the NYSE, AMEX, or NASDAQ.

The final point to consider is that markets don’t respond well to uncertainty. The bigger the impact of the event and the more uncertain the outcome, the more swings we should expect in stock prices. Graph 3 shows that since 1934, the average number of trading days where U.S. stocks moved by more than 1%. Election campaigns tend to surface new policies that are at odds with the current administration. Investors must reconcile both the likelihood that the challenging party will take power and the possibility the suggested policies will be implemented with the overall impact to potential growth for companies and our economy. That’s a lot of “ifs”. This added uncertainty has historically translated into more stock price volatility. So don’t be surprised if you see more bumpiness in markets leading up to election day – that’s what has happened historically and should be expected.

Given the three considerations above, the natural question is what should you do with your portfolio? The answer: stick to your plan. Investing should always start with a plan where you define what you hope to accomplish with your money and your investments. Everyone wants to see their portfolio grow, but most investors fail not during times of growth, but by panic selling when their portfolio starts to decline.

So rather than trying to reposition your portfolio to capture slightly better returns, flip the question: what are you concerned about with the next election (or now for that matter)?

- Are you worried that we’ll see a big selloff in stocks? Then you may want to look at adding high quality fixed income or sensible alternative strategies that can help mitigate the risk of stocks falling.

- Are you concerned about higher costs of living as you grow older? Consider investment options that respond positively when there’s high unexpected inflation, such as TIPS.

- Are you concerned that U.S. stocks won’t be able to continue their impressive performance? International stocks offer much more attractive valuations; consider adding more foreign companies to your portfolio.

Investing always involves risk – that’s why we expect positive returns – but you can build a portfolio to weather all types of market environments. When you create a portfolio that is designed around your concerns, you can focus on the candidates’ policies and vote confidently without worrying about how the outcome will impact your portfolio.

No one can predict the future, but we can plan for it. History has shown us that the market will fluctuate in response to changes in Congress and the uncertainty of elections. By staying the course, you can weather the changes that may happen. If you have any questions of how the upcoming election may affect your portfolio, Buckingham would love to help you. Connect with us for a short introductory conversation.

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based upon third party sources which may become outdated or otherwise superseded without notice. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. By clicking on any of the third party links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party Web sites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, or confirmed the adequacy of this article. R-22- 3757