January 17, 2023

2023 Planning Considerations and Strategies for Individual Taxpayers

With the largest inflation adjustments in nearly 40 years, the upcoming tax season brings some big considerations. Explore our list of key planning strategies and deadlines.

Tax planning shouldn’t simply focus on hindsight. Upcoming life changes and external factors such as tax policy developments also deserve attention and may offer opportunities to consider. With 2023 bringing the largest inflation adjustments in nearly 40 years, this is especially true, making it a great time to see how they could affect you.

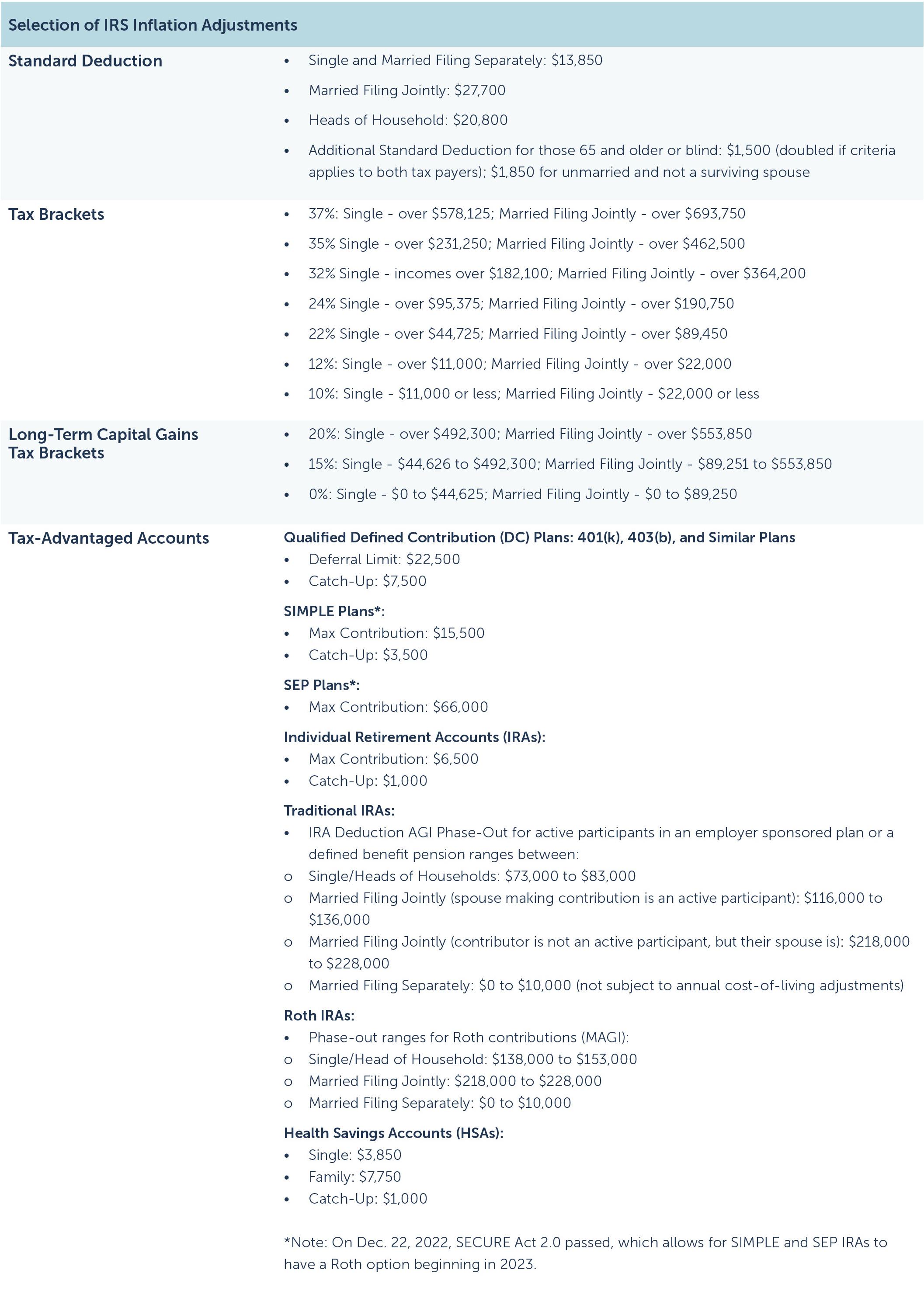

IRS Inflation Adjustments

The IRS makes inflation adjustments annually, and the increases have two purposes:

- To prevent tax bracket creep for those whose income keeps pace with inflation.

- To limit government revenue increases resulting from inflation.

Since the 1980s, the adjustment amounts have held within relatively predictable ranges. Given inflationary pressures, the 2023 adjustments represent the sharpest increase in nearly four decades. More than 60 provisions ranging from Social Security payments to income bracket and retirement savings limits received significant increases.

This should come as welcome news for the many households who saw their purchasing power decrease throughout 2022. However, even with these increases, as compared to January 2022, many families will still have less net income on an after-tax, inflation-adjusted basis. This article provides an overview of some key IRS inflation adjustments and the tax planning strategies associated with them. Click here for a summary PDF of our 2023 Tax Guide.

2023 Tax Planning Considerations

Standard Deduction

In 2017, the Tax Cuts and Jobs Act significantly increased the standard deduction amounts, making it unnecessary for many taxpayers to itemize. If this is the case for you, then strategically managing adjustable below-the-line deductions (charitable contributions, payments of state and local taxes, medical expenses, etc.) to maximize itemization may not be necessary. It also highlights the importance of effectively managing above-the-line deductions, which can be taken regardless of whether someone uses the standard deduction or itemizes. These include deductions for items such as Traditional IRA or HSA contributions, student loan interest and self-employed retirement contributions, among others.

Tax Brackets

All tax brackets increased by an average of 7%. Unless you had a significant increase in income, that gives a fair amount of room to remain in the bracket you were in for 2021, even if very close. By reviewing this early in the year, you can determine whether additional tax-reduction strategies could further reduce income so that you remain in the same bracket.

Long-Term Capital Gains Brackets

Long-term capital gains receive very advantageous tax treatment, so it’s important to ensure you benefit from them when possible. Proper planning can reveal opportunities and help prevent the following undesirable consequences:

- Unless necessary, hold appreciated investment assets for at least a year before selling. Doing so earlier will result in them being taxed at ordinary income rates, which are much higher than capital gains rates.

- Consider whether you may be subject to an additional net investment income tax (NIIT) of 3.8%. The NIIT is an additional tax on investment income for single filers with modified adjusted income (MAGI) exceeding $200,000, and joint filers with MAGI exceeding $250,000. If this is a possibility for you, it’s important to review in more depth with your advisor and tax professional.

- Account for asset location in your overall investment asset tax planning. If you have investment accounts with different types of tax treatment (e.g., taxable, tax-deferred and tax-free), strategically placing certain investments in certain accounts can help you significantly reduce the long-term impact of taxes on your portfolio.

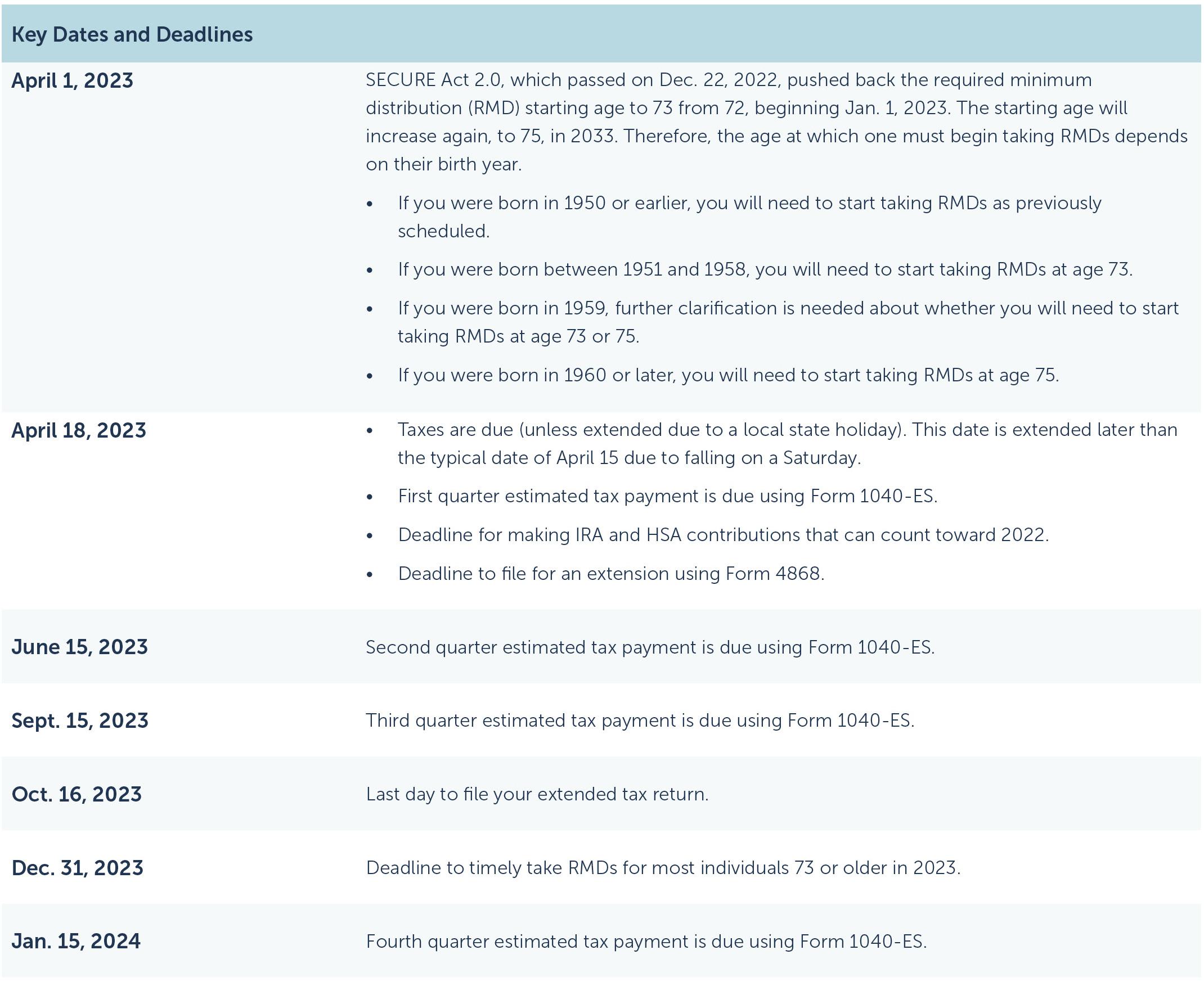

Tax-Advantaged Accounts

It’s important to maximize tax-advantaged options available, such as retirement accounts and HSA plans. As previously mentioned, contributions to many of these accounts are eligible for an above-the-line deduction that taxpayers can take whether they itemize or not. Not only do they help save on tax payments today, but they also provide ongoing tax benefits in the form of tax deferral. Planning early can allow you to spread those contributions out over the year as opposed to potential last-minute large sums to help reduce taxes.

It is also important, however, to take a long-term view of tax deferral. It can be tempting to defer as much as possible to lower taxes today. But doing so could have adverse effects on tax payments in the future. The tax consequences for when the money is distributed should be considered. The decision to pay more taxes today could even come in the form of making non-deductible Roth IRA contributions (for those who qualify), or by converting tax-deferred accounts into a Roth IRA to allow for tax-free growth.

Other Inflation Adjustments

This article outlines only some of the key items that were adjusted for inflation. Depending on your situation, you may want to explore others, such as the Foreign Earned Income Exclusion, Gift Tax Exclusion or Qualified Adoption Expenses.

We recommend speaking with your financial advisor to discuss which inflation adjustments would be most relevant to your circumstances as you begin tax planning for 2023.

If you are not currently working with an advisor, we would love to help you. Please schedule a short phone call or virtual conversation with our Client Development team.

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based upon third party data and may become outdated or otherwise superseded without notice. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, or confirmed adequacy of the content presented above. R-23-4935

Category

Tax StrategiesAbout the Author

Matthew Nelson

Buckingham Advisor Resources Manager